Generational wealth:

The importance of Teaching your children how to invest and thrive for the future.

In this post let’s look at our habits as adults, how are we all doing in terms of healthy money habits?

How do we manage our money?

Do we even manage it at all? or does it just disappear?

I know for myself there’s always room for improvement and sometimes I just don’t do what I know is best in terms of my finances, simply because I want something now and I don’t want to wait, but hey, we’re all human. The important thing (I think) is that we keep trying to do better at it, that’s how we create new habits.

Let’s take a quick look at three habits that if implemented in our lives will help to grow wealth and change our future towards wealth being generational.

(I can’t stress enough the importance of at least making an effort with these three habits, and if it doesn’t stick the first try, just keep at it, over time you’ll see an improvement in your finances.)

Habit 1: Be thoughtful about your spending

Being frugal does not mean being cheap. Maintaining a frugal budget means spending your money on the lowest-priced but highest-quality product or service available. Sometimes a high quality item is cheaper in the long run.

A simple step that anyone can do before pulling out their credit card is price compare online, and check reviews, simply pull up a few tabs and search for the lowest price for the exact same product or service from a number of different retailers. The key to this process is patience, and an understanding of when and where you can find the best deals. Wholesalers for example, can actually help you save on groceries.

If you rush your purchase, you may not get the best value. Depending on the item or service, there might be lower prices on a seasonal basis, thanks to holiday or clearance sales.

(While I hate penny pinching and am often accused of being to liberal with money, I have grown to love a good deal, and well…..there’s a noticeable difference in my finances since I’ve made an effort to create this habit.)

Habit 2: Save 20% or more of your income

Implementing this habit means maintaining a standard of living that allows you to live off of 80% or less of your net pay. You can work up to this goal. If you are able to begin saving immediately after graduating high school or college/university, for example, this savings percentage can be as low as 10%.

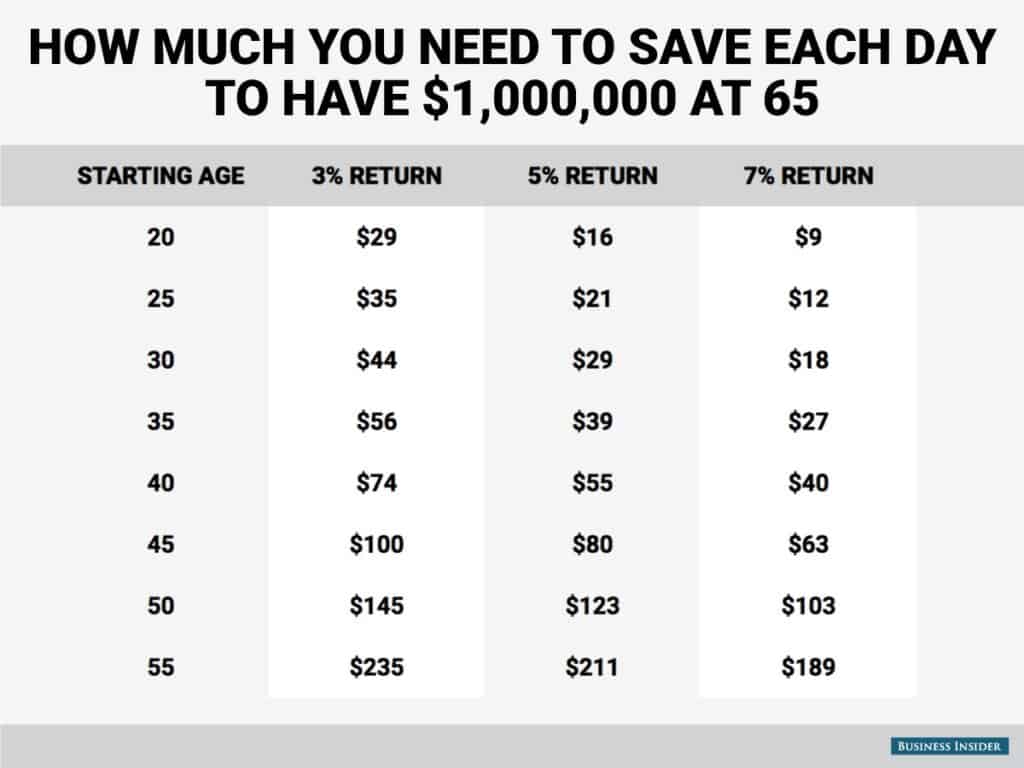

Time and the power of compounding give saver-investors a significant advantage.

It’s never too late to start saving and investing, either. You just may need to make some adjustments depending on where you are in life.

As a rule of thumb, every 10 years you delay forming this habit will require an additional 10% savings. For example, if you start saving in your 40s, you’ll need to boost your savings rate to 30%. If you’re in your 50s, you’ll need to save 40%.

For aspiring saver-investor millionaires, accumulating wealth requires that you make a habit of paying yourself first, putting yourself ahead of all of your other monthly bills. This “savings first” or “paying yourself first” strategy creates the funds that you will then invest.

If you don’t save, you can’t invest. It’s a process. But once you make saving a habit, you can then put your savings to work by prudently and consistently investing, so your wealth can grow — even while you sleep.

Habit 3: Create a bucket system for savings

Identify specific savings priorities and devote a percentage of your savings to each bucket: examples could be: wedding, first home, emergency fund, college savings, investment capital, retirement and so on.

And remember that that the system is subject to change as your needs and goals evolve.

For those of us that are parents, if we want to teach our children healthy money habits and help create the idea of generational wealth we’d better work on our own habits too!

As always Its interesting to hear from our readers with any comments and feedback to which we will respond as much as we can. You can reach us here: info@decentralisedlife.com

until next time,

Frank